Lending

An extensive report covering income, risk, liability, and cashflow analysis, applicable for both manual and automated underwriting

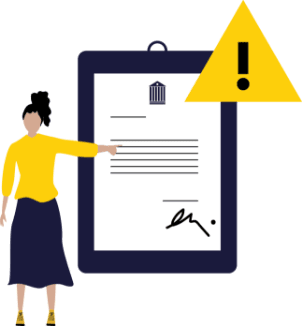

Mitigate risks &

prevent fraud

Reduce fraud exposure and prevent losses. Instantly identify any gaps and inconsistencies with our visual breakdowns and key risk indicators.

Enable more accurate,

real-time decisioning

Obtain a holistic financial picture of your customers in a matter of seconds. Power more competitive products and faster, truly digital experiences.

Gather insights from

any data source

Get the most insights out of your customers’ banking data—whether it’s from Flinks or a third party. Minimize manual processes and human intervention.

Get the full benefit of your transaction data with Flinks Enrichment. From a snapshot of your customers’ financial profile to custom data modeling, our data analytics engine has you covered.

An extensive report covering income, risk, liability, and cashflow analysis, applicable for both manual and automated underwriting

High-level income analysis with breakdowns of employer, non-employer, and government income for fast and easy income verification

A comprehensive picture of your customers’ financial profile with a combination of income, fraud, and risk insights

High-level risk analysis covering key financial information with additional risk factors that help you assess credit and mitigate risks

An advanced report offering key aspects of business accounts such as operational income and expenses to speed up commercial underwriting

Ready to see more ?

Get a demo