Flinks gives you the power to build the future of finance. Connect, enrich and utilize financial data to delight your customers with amazing products.

Homegrown: How EQ Bank Partnered with Flinks to Modernize their Mortgage Experience

What if mortgage approval was built as a simple, user-friendly digital experience?

EQ Bank knows the traditional mortgage approval experience doesn’t cut it anymore. Their team didn’t wait for others to set the new standard; they took it upon themselves to build the modern, digital mortgage experience consumers want — and partnered with Flinks to achieve that goal.

“Equitable Bank is on a mission to help clients and make the mortgage experience simple and deliberate.” — Paul von Martels, Vice President, EQ Bank

The result is an end-to-end transformation that streamlines identity and funds verification processes by making a better use of digital automation.

Read on to learn how EQ Bank uses Flinks’ products to transform their mortgage underwriting process and deliver a smooth, digital experience.

Objective

- Provide their clients with a modern, user-friendly digital mortgage experience, powered by a better use of digital automation

Approach

- Allow clients to share statements directly from their banks through a dedicated digital interface built on Flinks’ data connectivity

Benefits

- Reduce time to approval by completing application files faster

- Offer a much simpler and convenient way to share required documents and information

- Verify income and sources of funds using high quality data

- Reduce fraud risks by sourcing data directly from banks

Save this case study for later. Download as a pdf.

End-Users – Feeling Right at Home

For most people, buying a house is the biggest purchase they will make in their lifetime. This process entails many steps, including getting approved for a mortgage, which in itself can be pretty stressful.

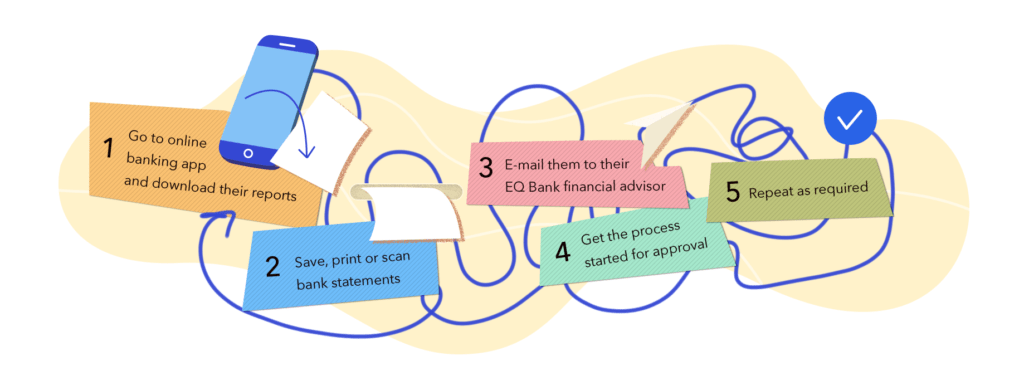

Financial institutions need to collect high quality data and lots of documents to move their mortgage underwriting process forward — and the burden is put on their clients to collect and share all of that, making a typical onboarding process look like the following:

EQ Bank understood the frustrations and wanted to make sure that this experience was as seamless and pleasant as possible by creating a branded process flow that was easy and convenient.

A particularity of EQ Bank’s clientele is that many are business owners with “complex and many bank accounts” — which means that oftentimes their accounts are used for both personal and business/commercial transactions. This poses a challenge for the bank in their mortgage underwriting process as well as for their clients during the account verification phase.

“How can we make this easier for clients — and better for us?”

They decided to answer that question using Flinks.

Connectivity for Income Verification

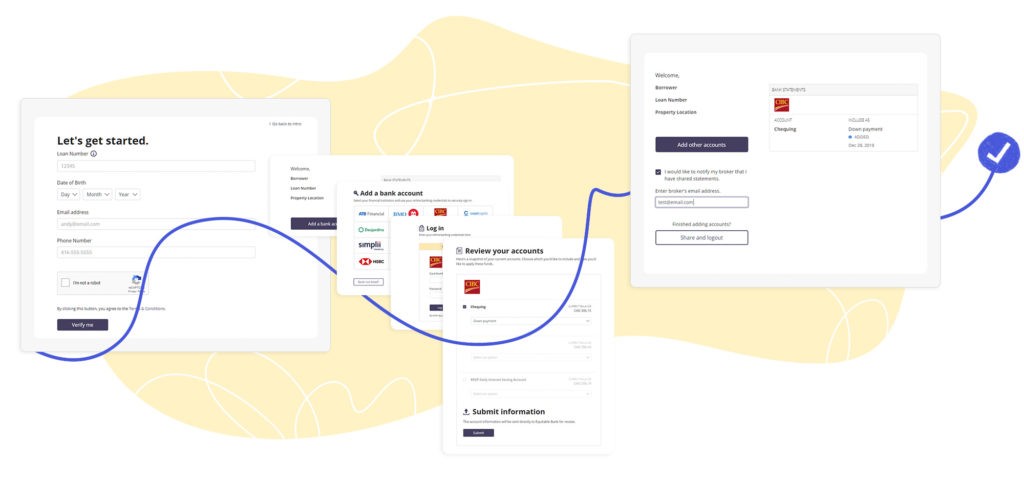

“We use [Aggregation] mostly to facilitate income verification”, says Paul von Martels, Vice President of EQ Bank. EQ provides their clients with a dedicated digital interface, Bank Statement Share, built on Flinks’ financial data connectivity. This enables prospective mortgage clients to quickly and securely share the information needed to complete their mortgage application, at the press of a button.

“Files are securely transferred from our front-end, which is powered by Flinks, to our document repository system for safe-keeping. It has made things a lot easier for our clients.”

Furthermore, EQ’s Bank Statement Share adds a layer of trust and security between clients and their brokers. “There’s zero possibility of missed pages or misrepresentation — all of that concern is eliminated”, says von Martels. Financial data is sourced directly from banks, which eliminates the risk of clients sending sensitive documents to the wrong email address.

“We’ve seen greater uptake and usage of the tool, [and] a meaningful percentage of our mortgage deals now uses [it].”

EQ Bank’s Team – Home Run

Providing clients with a better way to share their documents is only half the story. EQ Bank leverages bank-sourced financial data to optimize their back-office processes, namely by streamlining their mortgage underwriting process.

Income verification and identification of the sources of funds

Processing mortgage applications has traditionally been time-consuming and labor-intensive. An important step for completing the review of a mortgage application is to verify income and identify the sources of funds.

“When clients send their bank statements directly to us by email, they’re sending them in PDF format — which requires manual work to process and to review for inconsistencies.”

As mentioned, a fair share of EQ’s clientele has “complex bank accounts”, which only complicates the verification of income and sources of funds. Now, when clients connect their accounts through EQ’s Bank Statement Share, Flinks cleans up and organizes their data to provide visibility over their complex financial lives. The bank’s underwriting team can proceed more swiftly and complete the review of the application within a shorter time frame.

Mortgage underwriting process: compliance and fraud prevention

It’s notoriously difficult to pinpoint alterations of documents. While fraud prevention wasn’t part of the initial goals motivating EQ to use Flinks, the challenger bank has found that sourcing information and documents directly from financial institutions can help mitigate risks.

In a nutshell

Financial data connectivity gives EQ Bank full access to high quality, reliable banking information as well as original documents to be able to gain a better understanding of their clients’ financial situation.

EQ’s Bank Statement Share allows the bank to expedite data collection and processing, which speeds up their mortgage approval process—a win for both EQ and its clients.

Collaborating with this client’s team from the get-go helped us help them opt for the best integration for their business model, creating as little disruption as possible during the integration and allowing them to reap the benefits quickly. We were also able to educate them on what could be achieved with financial data aggregators, making sure that their satisfaction level remained high long after the integration of the product was completed.

If, like our client, you would like to build your product on seamless bank account connections and robust data refreshes, talk with our experts. They will be able to guide you on how to deploy financial data connectivity in the context of your business.

You might also like

How NCR Financial Uses Flinks to Improve Lending Underwriting

Digital lender NCR Financial uses Flinks to gather its customers’ transaction history and make instant, automated underwriting decisions.

How Wise Uses Flinks to Activate Customers and Reduce Risk

Wise delivers instant and convenient money transfers (EFT). Here’s how Flinks helps make it happen.