Flinks gives you the power to build the future of finance. Connect, enrich and utilize financial data to delight your customers with amazing products.

Fully Digital Lending: How Personal Lenders are Going Digital with Flinks

Efficient lending is at the core of economic life. It’s what allows people and businesses to bridge income and expenses.

As consumers’ financial situation and the way they access the services they need are changing rapidly, providing a digital lending experience opens up massive opportunities.

To capture these opportunities, our clients in the personal lending space are leveraging Flinks’ financial data connectivity and enrichment tools to drive digitization initiatives.

- They are rebuilding their risk models in ways that allow them to reach new market segments.

- They are redesigning their digital experiences to deliver value faster while maintaining strong KYC and anti-fraud compliance-oriented processes.

- They are streamlining their back-office processes by equipping their workforce with digital tools, cutting down costs of operations.

This series of case studies explores how our clients are adjusting to today’s market and setting the foundation for scalability by going fully digital with Flinks.

Quick links

- Case study 1 — Strengthening the foundation with better risk models

- Case study 2 — Streamlining the application process to deliver value faster, with an end to end digital experience

- Case study 3 — From manual to virtual: building a digitally-enabled workforce

- Let’s get started today (for real)

Case study 1 — Strengthening the foundation with better risk models

Objective

- Understand and serve mid-market customers, whose specific financial situation isn’t captured by credit reports and other traditional data sources

Approach

- Rebuild underwriting models by using raw or enriched bank data as inputs

Benefits

- Extend ability to underwrite loan to subprime customers

- Reduce risk

Objective

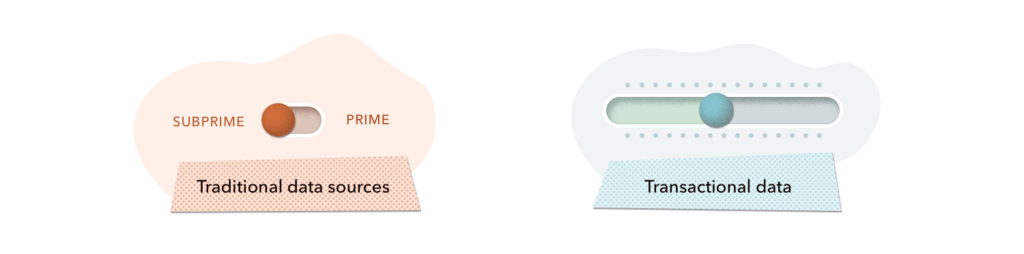

Traditional credit scoring systems work well for financially active and well-off consumers. However, large segments of the population in the subprime category are struggling or sometimes flat out unable to prove their actual creditworthiness through these means. Additionally, credit reports are slow to capture sudden changes in a person’s financial situation, which lately took on a significant importance.

More and more, lending companies that have built their risk models on inputs from traditional data sources are seeing how the information they get limits their ability to underwrite loans, or forces them to take higher risks.

Most of our clients in the personal lending space have become interested in implementing our data tools because they wanted to serve — and better understand — the wide-ranging mid-market.

Approach

In order to meet the demands of mid-market customers for credit products, our clients have rebuilt or deepened their risk models using financial data as inputs.

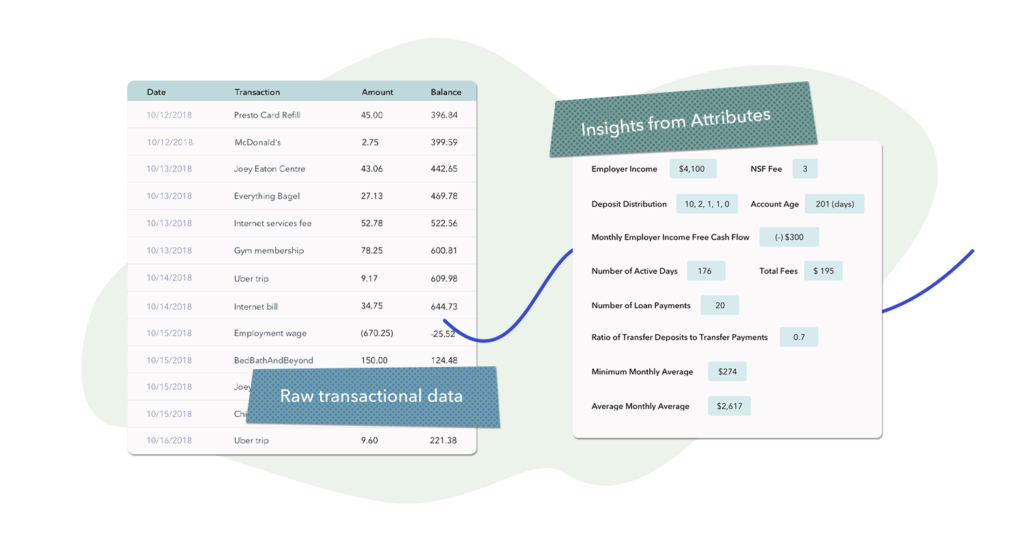

To access their applicants’ personal financial data, our clients first have to implement financial aggregation in their loan application flow. This allows them to automatically collect up to 12 months of raw transactional data for each potential borrower.

This is exactly the kind of information that makes it possible to understand a non-prime borrower’s specific financial situation.

A person’s transaction history can provide visibility over how much they earn and spend, where and when, over an extended period of time.

But raw transactional data itself isn’t readily actionable.

A portion of our clients choose to process it themselves — either because they have data science resources available, or their analysts manually comb through the transactions. This latter option is akin to reviewing with bank statements.A majority have now integrated Attributes, which takes care of data processing for them and returns insights that they can use as direct inputs in their risk models.

They instantly gain visibility and take action on key features of their applicants’ financial profile, such as income, free cash flow, loan payments, fees, minimum balance, and more.

Benefits

Transactional data unlocks a deep understanding of a person’s specific financial situation, which is key to serving mid-market customers. Our clients drill down on the insights they collect to improve their risk models. Over time, we’ve seen them build much wider sliding scales in their credit products, to match their clients’ risk profiles with the adequate annual percentage rates (APRs).

In short: serve the right credit products to the right customers, from a larger range of risk profiles.

Case study 2 — Streamlining the application process to deliver value faster, with an end to end digital experience

Objectives

- Deliver value faster by offering a digital onboarding experience that handles identity and information verification

- Ensure this digital onboarding experience satisfies industry regulatory requirements

Approaches

- Build KYC checks and instant bank verification (IBV) on bank-sourced information

- Collect relevant information within the digital experience, without having to ask users to leave and come back

Benefits

- Reduce time to value by onboarding in minutes instead of days

- Reduce cost of acquisition by lowering drop offs

- Reduce exposure to fraud and tampered documents

Objectives

Identity verification and fraud checks are a frequent source of friction across financial services. However, the time it takes to get the required documents and paperwork is especially painful in personal lending.

In a classic lending environment, this often means in-person meetings, lengthy applications forms, detailed reference checks, and physical signatures. Although more convenient, digital lenders also typically require applicants to jump through hoops: finding and uploading official PDFs and taking snapshots of government-issued ID hardly qualifies as a seamless experience.

Additionally, asking applicants to share documents or self-disclose key aspects of their financial profile exposes lenders to fraudulent documents and falsified information.

One of the key differentiators in personal lending is the ability to deliver loans quickly.

When people apply for a personal loan, they have weighed their options and are ready to act. The challenge, of course, is to achieve a high speed of execution while meeting regulatory requirements and reducing fraud.

A number of our clients in the personal lending space have taken full advantage of financial data connectivity to build end to end digital onboarding experiences and deliver value faster.

Approaches

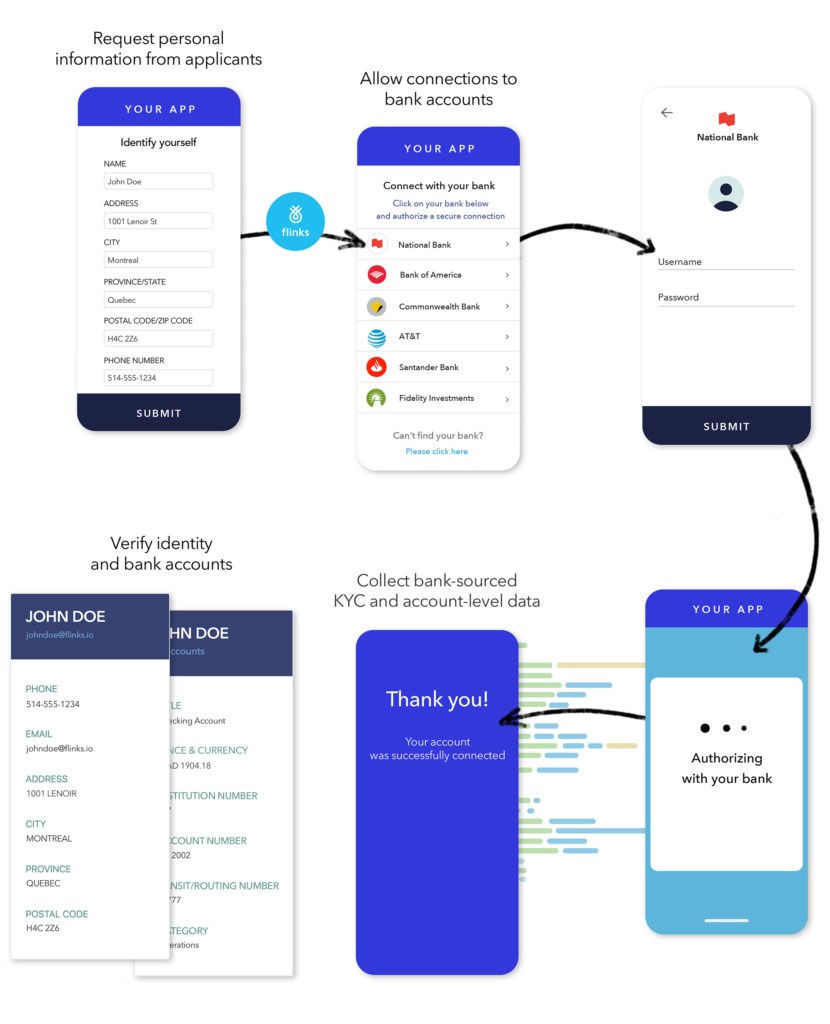

By using financial data connectivity, our clients can collect a variety of information that goes way beyond transaction history — it covers the personal and account-level information our clients need to meet regulatory requirements for KYC checks and bank account verification.

Here are some of the most common data elements:

Personal information

- Name

- Phone

Address

- Civic Address

- City

- Province or State

- Postal or Zip Code

- PO BOX

- Country

Account-level information

- Title

- Balance and Currency

- Category and Type

Account Details

- Institution Number

- Account Number

- Transit or Routing Number

- EFT Eligibility

Instead of asking loan applicants to provide documents themselves, our clients embed Flinks within their digital onboarding flow and simply lead new customers to connect to their bank accounts.

In a matter of seconds, loan applicants connect to their bank accounts and authorize a data transfer — right within our clients’ digital experiences.

Flinks is embedded directly in online experiences and apps, which makes connecting to bank accounts a seamless experience. We provide a number of integrations options, including a widget and a self-hosted solution.

Benefits

Our clients leverage financial data connectivity to satisfy and digitize critical regulatory requirements — KYC and bank account verification — while offering their new customers a quick and seamless onboarding experience. Onboarding processes that previously took days are replaced with data transfers that can be done in minutes.

In doing so, they lower risks of having their customers drop off the application process, and reduce their exposure to fraudulent information.

Most importantly, they can provide them with same-day loan delivery.

Case study 3 — From manual to virtual: building a digitally-enabled workforce

Objective

- Build a digitally-enabled workforce operating data-driven processes

Approach

- Replace repetitive, time-consuming and low-impact tasks with digital processes

Benefits

- Reduce cost of operations by streamlining back-office processes

- Free time and resources to focus on what matters: the relationship with customers

Objective

Still to this day, lending companies ask their analysts to perform repetitive, time-consuming tasks and low impact tasks in order to handle and analyse loan application information.

Manually reviewing PDFs and transferring information on spreadsheets, for instance, creates an internal data management challenge that generates more work for analysts and management alike.

As a result, these lenders’ adjudication process has a suboptimal response time — a downside for everyone involved.

A number of forward-thinking clients are seeing our data enrichment tools as an opportunity to drive digital transformation in their business.

They focus on building a digitally-enabled workforce that can adjudicate loans faster and with more accuracy, which frees up time to focus on what matters: the customer relationship.

Approach

Getting the documents required to adjudicate loans is only half of the story: data points must be extracted and turned into actionable insights that can lead to a decision. The same goes for financial data connectivity: access is just a start — raw transactional data must be processed in order to be useful.

Our clients use data enrichment to streamline their back-office processes by eliminating the need to manually handle data. When loan applicants connect their bank accounts, Attributes ingest their transaction history and outputs the data points they need to run their risk-decisioning models.

A minority of our clients have the technical capabilities to integrate the Attributes API directly into their CRM, which allows them to turn loan adjudication into a fully digital and data driven process.

In most cases, our clients use the Flinks Portal as a central part of their digital workflow and an essential tool for their analysts.Their customer-facing experience leads loan applicants to connect to their bank accounts. Using Portal on the backend, their analysts can generate income and credit risk reports at the press of a button to quickly access actionable insights from Attributes.

Benefits

Digitizing data-driven processes such as adjudication is tremendously helpful for scalability: lenders are no longer limited by the amount of time it takes their analysts to properly extract data points and manage spreadsheets — it can all be done with the push of a button.

Reducing costs of operation by digitizing back-office processes has never been easier.

Additionally, by freeing up time and resources, our clients are now able to focus on their relationship with their customers. Our case study of NCR Financial offers a prime example of how financial data can be leveraged to offer top tier customer experiences.

Let’s get started today – for real

Digital transformation is a complex undertaking, and very few companies have the resources to build everything they need themselves.

Our clients show that it’s possible to take a bit-size approach by using transactional data to understand their customers better, building a digital onboarding experience, and equipping their workforce with digital tools that cut down time to adjudicate.

We understand that tech resources are costly and that it might be hard to juggle different priorities. Our answer to the growing need for turnkey tools is “Digitization in a box”: an out of the box integration of Flinks that enables you to get a fully digital data connectivity and enrichment flows up and running without having to write a single line of code.

Digitization in the financial sphere has gained definite momentum in the recents months, and it’s here to stay. What are you waiting for to take your business to the next level?