Yves is Flinks' Content Strategist. He tells the world about the dramatic changes happening in finance, one story at a time.

How Wealthsimple and Flinks Turn Consumers Into Investors in Minutes

As a whole generation was coming of age professionally, it became clear 18-40 year olds struggled to hit savings milestones, and didn’t find much help with what traditional investment providers had to offer.

Wealthsimple’s team meets their challenge head-on by delivering a brand new type of experience—one with enough appeal to get them investing for retirement. Today, the fintech acquires more users than virtually any other financial services provider in Canada.

“Today we have over 1.5 million Canadians using Wealthsimple products and counting. With Flinks we’re able to onboard thousands of clients daily in a matter of minutes, making a complex process as simple and frictionless as possible.”

— Laura Lampe, Senior Director of Operations, Wealthsimple

Read on to find out how Wealthsimple builds upon Flinks’ data layer to deliver an experience so simple and friendly—consumers sign up and start investing in less time than it takes to fill a paper form.

Objective

- Deliver on their brand promise to make financial services simple and easily accessible, right from the start of the client-relationship—in their onboarding experience

Approach

- Build sophisticated, data-driven KYC/AML, account authentication and fraud detection processes, powered by financial data connectivity

Benefits

- Set the industry standard for fully digital user onboarding

- Maintain an affordable CAC through high volume growth

- Deliver a branded experience that primes users for a long-term relationship

Save this case study for later. Download as a pdf.

Building the new standard in financial services

In just a few years, Wealthsimple has made its place among North America’s leading fintechs. And, most importantly, on the smartphones of hundreds of thousands of users.

This is no small feat. Younger generations typically don’t relate to traditional savings and investments offerings. Wealthsimple is able to cut through the noise with an appealing promise: everyone can achieve their financial goals, you simply need the right tools.

Digital, it turns out, is the perfect environment to build the new standard in financial services: a simple, friendly experience that puts users in the drivers’ seat.

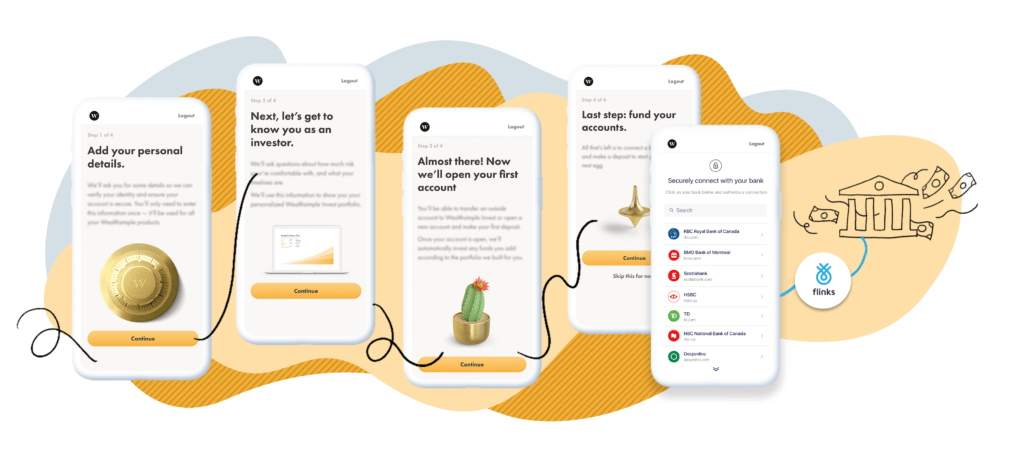

Wealthsimple’s team has built a fully digital experience that breaks away from the hallmarks of financial services—in-person appointments and clunky paper or digital forms—in order to make investing accessible.

Finance is a heavily regulated industry: like any other financial institution, Wealthsimple needs to meet complex compliance requirements every time they welcome a new user by collecting KYC and AML information. To help authenticate users quickly and seamlessly, they turned to Flinks to integrate financial data connectivity into their onboarding process.

With a single step from the user—connecting their bank account right within the onboarding experience—Wealthsimple is able to retrieve the following KYC and AML data points:

Data points returned by Flinks

Personal information

- Name

- Phone

- Civic Address

- City

- Province

- Postal Code

- PO BOX

- Country

Account-level information

- Institution Number

- Account Number

- Transit Number

Utility

For internal risk and compliance purposes:

- Verify new users’ identity using bank-sourced information

- Authenticate new users’ bank accounts

- Detect fraudulent users on a variety of factors

Using digital to simplify everyone’s life

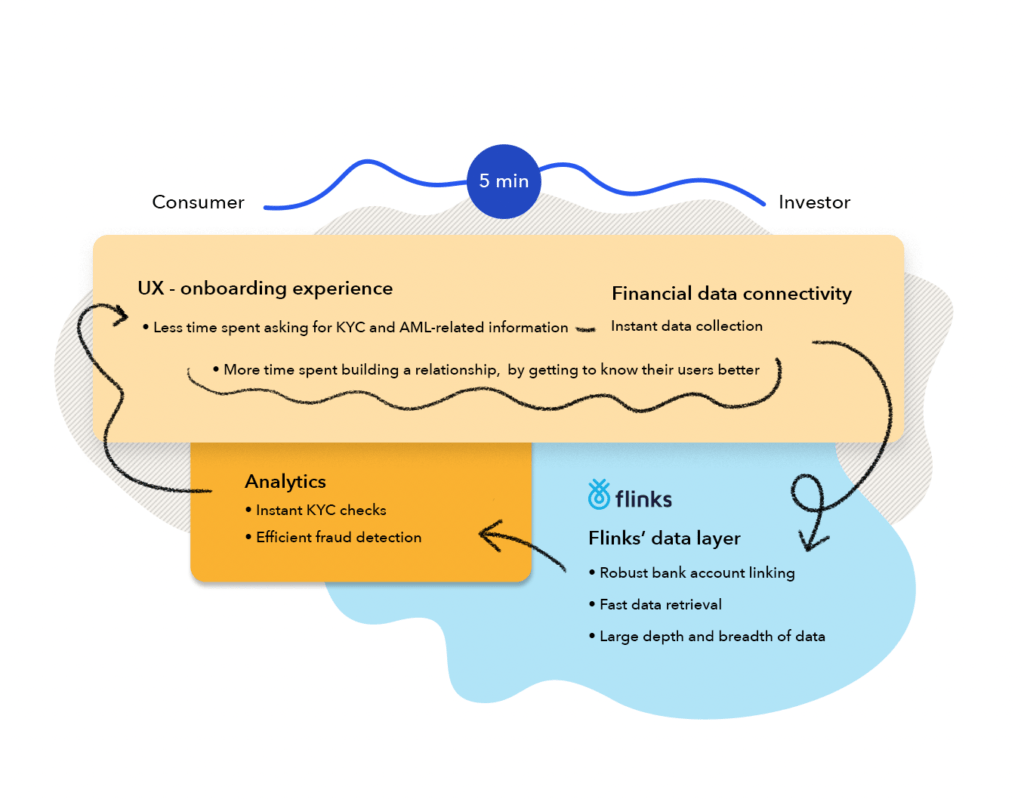

A key lesson of Wealthsimple’s success is this: delivering a simple, friendly experience isn’t just about inspired front-end design. It’s ultimately the consequence of extremely sophisticated back-end processes.

Wealthsimple embeds financial data connectivity with Flinks directly into their digital onboarding experience. This allows users to share critical information required to complete the process.

The deeper value, though, comes from the way Wealthsimple leverages data. Flinks’ data layer delivers standardized data across a large network of financial institutions, which Wealthsimple can use to power sophisticated KYC and AML data analysis.

- On the business side, this helps Wealthsimple run scalable and cost-effective client acquisition processes.

- On the user experience side, Wealthsimple expedites authentication steps, and sets up users in just a few minutes.

The combination of instant data sharing and high quality data points provided by Flinks allows them to focus on what really matters: building a relationship with their new users, as they get them started on the path towards their financial goals.

Getting started quickly… at getting rich slowly

Some companies have such a great impact on their market that their customers find it hard to remember life before them, or imagine life without them. Wealthsimple gained its initial traction as a robo advisor—but they are in the business of building long-lasting relationships.

“Ultimately our goal is to deliver great financial products and services to everyone, regardless of their age, net-worth, background or education.”

— Saksham Uppal, Group Product Manager, Wealthsimple

Flinks’ data layer enables them to make a great first impression by bringing users to value in a quick, intuitive way. And as Wealthsimple grows its user-base, so, too, do they grow the suite of financial products they offer them.

If, like our client Wealthsimple, you would like to build your product on Flinks’ robust data layer, talk with our experts. They will be able to guide you on how to deploy financial data connectivity in the context of your business.

You might also like

How PayBright Runs the Ultimate Buy Now, Pay Later Experience on Flinks

Find out why PayBright relies on Flinks to perform critical functions powering its POS installment payment solution.

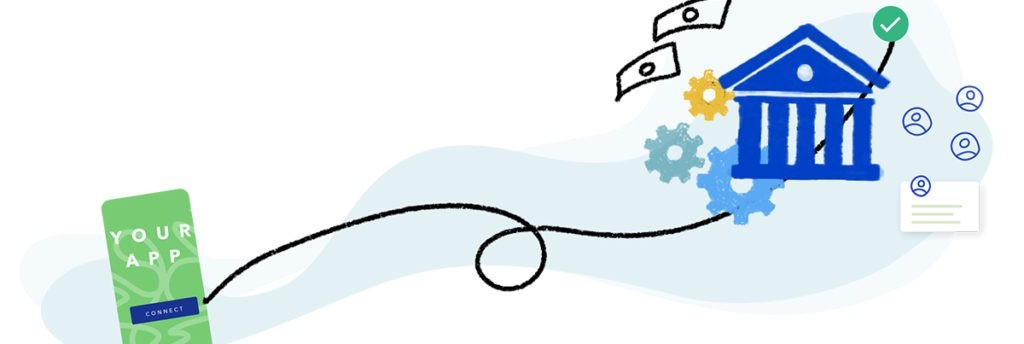

Power your app with next-gen data connectivity

Let users connect their financial accounts and gain access to retail or business banking & investment data. From KYC or transactional data to investments accounts, assets, and more, we got you covered.