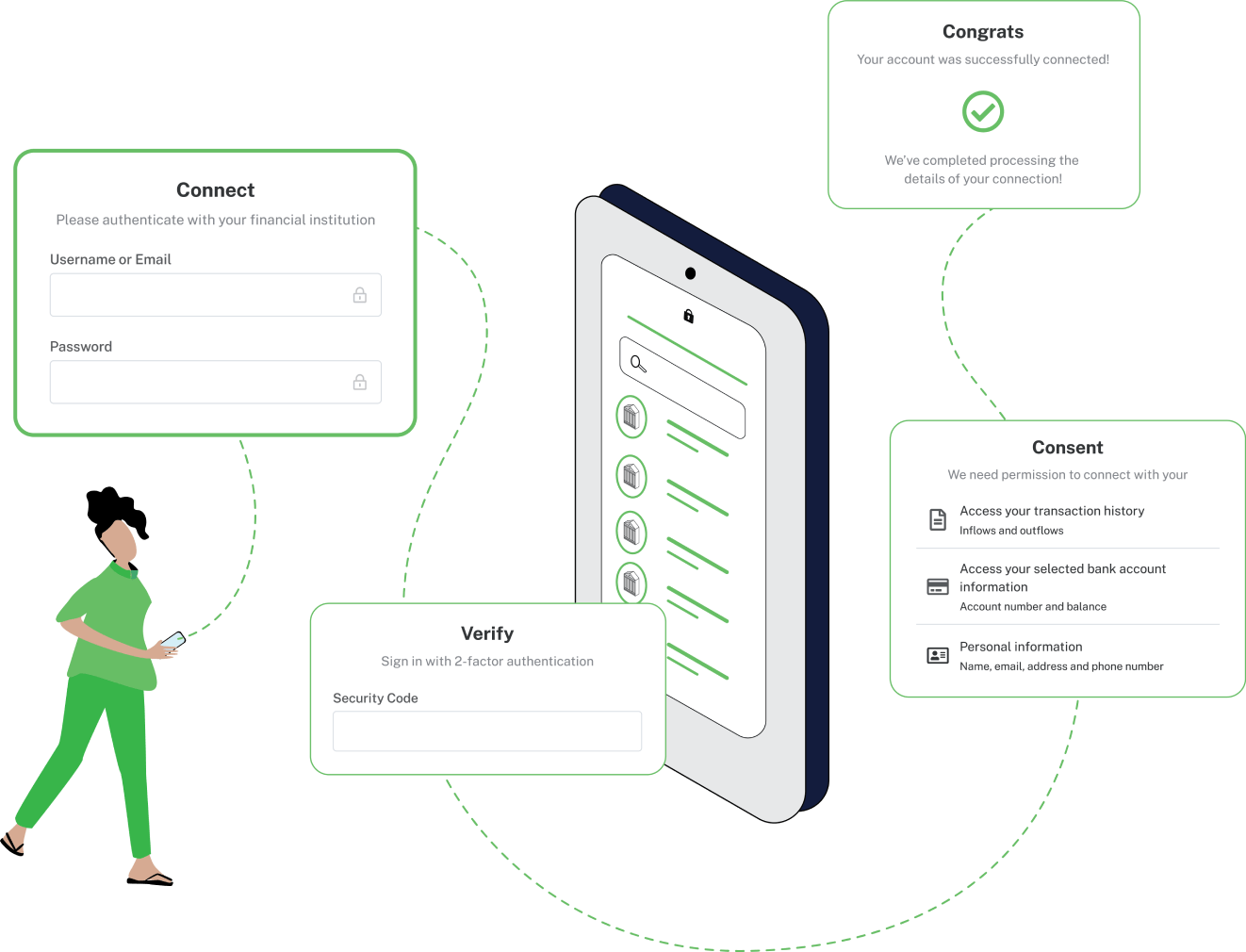

The best way to connect your users' bank accounts and to collect data. OAuth connectivity increases conversion rates with reliable data capture. From KYC to transactions, statement and void cheque upload we got you covered.

The financial data infrastructure powering innovation

Connect users' bank accounts, turn data into actionable insights, and deliver a winning open banking program.

Trusted by

Data tools for connected financial services

- Connect

- Enrich

- Outbound

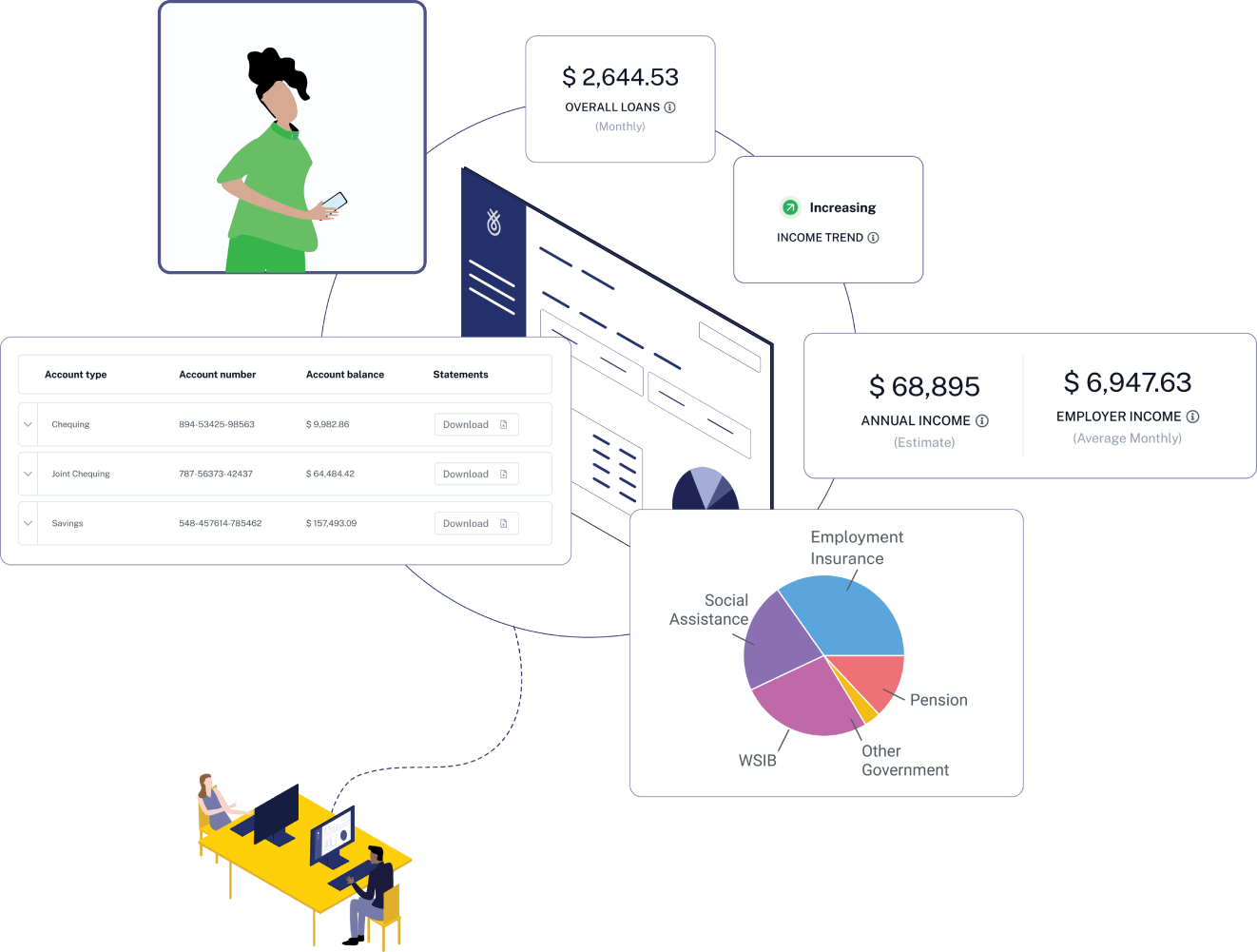

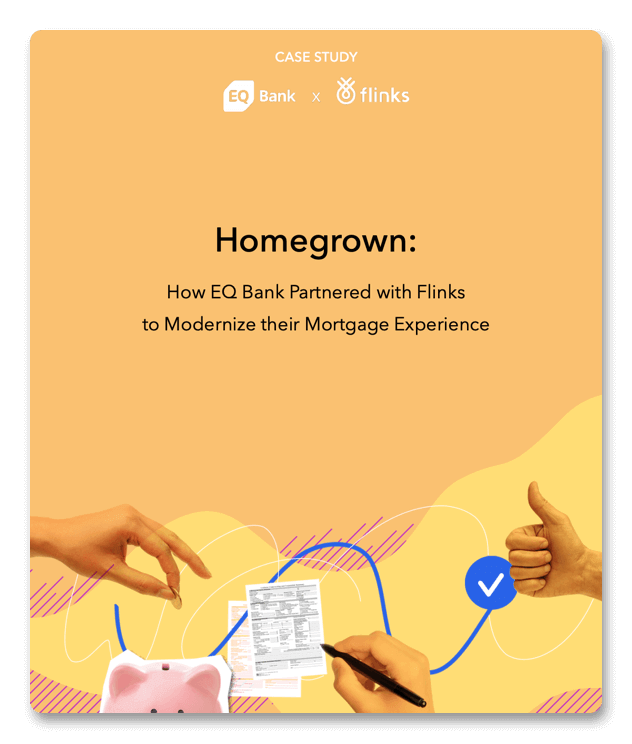

Get actionable data insights

Turn raw transaction data from any aggregator into actionable insights. Make sense of banking data to power more accurate credit decisioning.

Deliver a winning open banking program

Build your own open banking program, fit for many data-sharing use cases. Drive volume instantly, thanks to Flinks' network.

Why Flinks?

Winning with open banking goes far beyond just technology and APIs. Our extensive network of third-party applications that millions of Canadians are already using can become your launchpad.

Build the financial institution of the future

Pick your industry. We’ll show you what the future holds.

Find out why innovators build with Flinks

- Get expert advice on your use cases

- Discuss integration & pricing options

- Take the best path to get started