Lending

Convert more borrowers with smarter credit decisioning

Supercharge your loan underwriting with Flinks IBV & financial data enrichment.

With direct connectivity to banks and actionable data insights, Flinks helps you approve more loans faster while mitigating risk and defaults.

Get a demo

Trusted by

Challenge for lenders

Assessing creditworthiness has been a tedious chore for lenders, especially when it comes to first-time borrowers –

Lenders need to collect data from different sources, review inconsistencies, not to mention manually calculate cash flow.

Flinks’ solution for lenders of all types

Flinks can accelerate your underwriting by up to 30%*.

We transform transaction data into real-time insights focusing on income, risk, and fraud. This helps you identify potential prime borrowers and approve more loans with confidence.

*Stats based on a sample size of Flinks’ clients

Make the best and the most informed credit decisions

Underwrite with speed and accuracy

Streamline your cash flow analysis with a snapshot of your customers’ financial profile so you can prequalify more borrowers.

Mitigate fraud and control defaults

Strengthen credit assessment by identifying your borrowers’ primary account, flagging fraudulent activities, NSFs, stop payments, and more.

Level up your underwriting with tailored insights

2,500+ data insights that can be easily integrated with your CRM and LOS/LMS, powering your credit decisioning and advanced modeling.

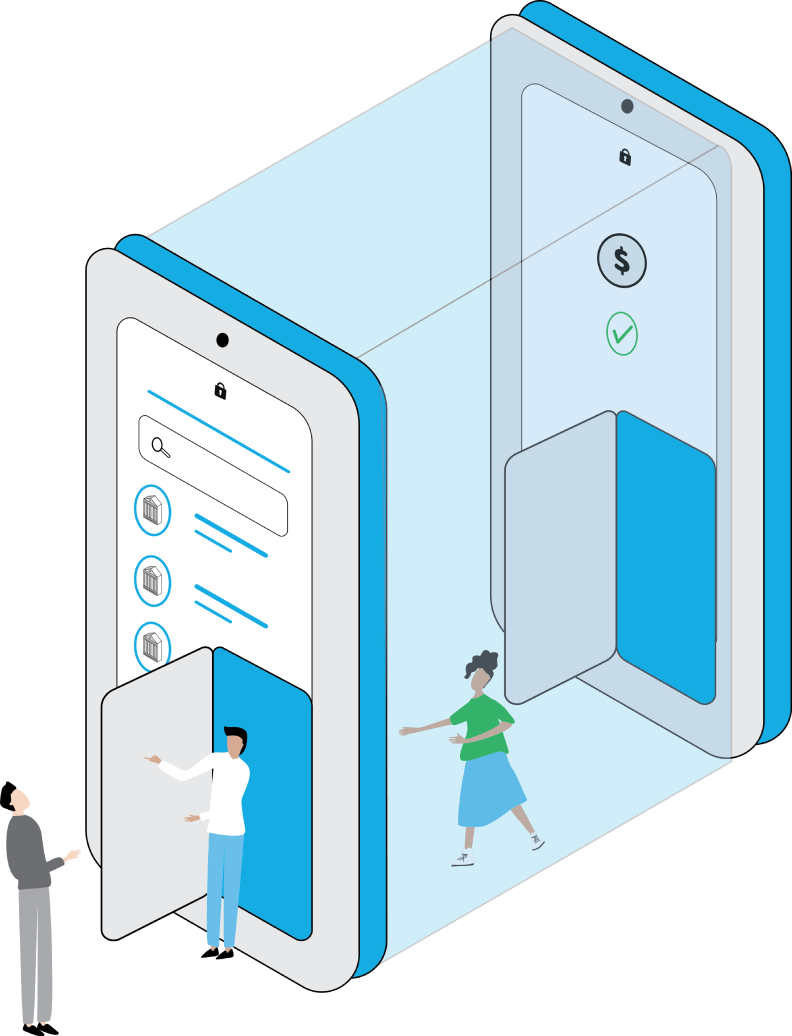

Automate customer onboarding and verification

Simplify your loan application process and improve your conversion rates at scale with our instant bank verification (IBV) and income verification.

Transform your lending experience the way you want it

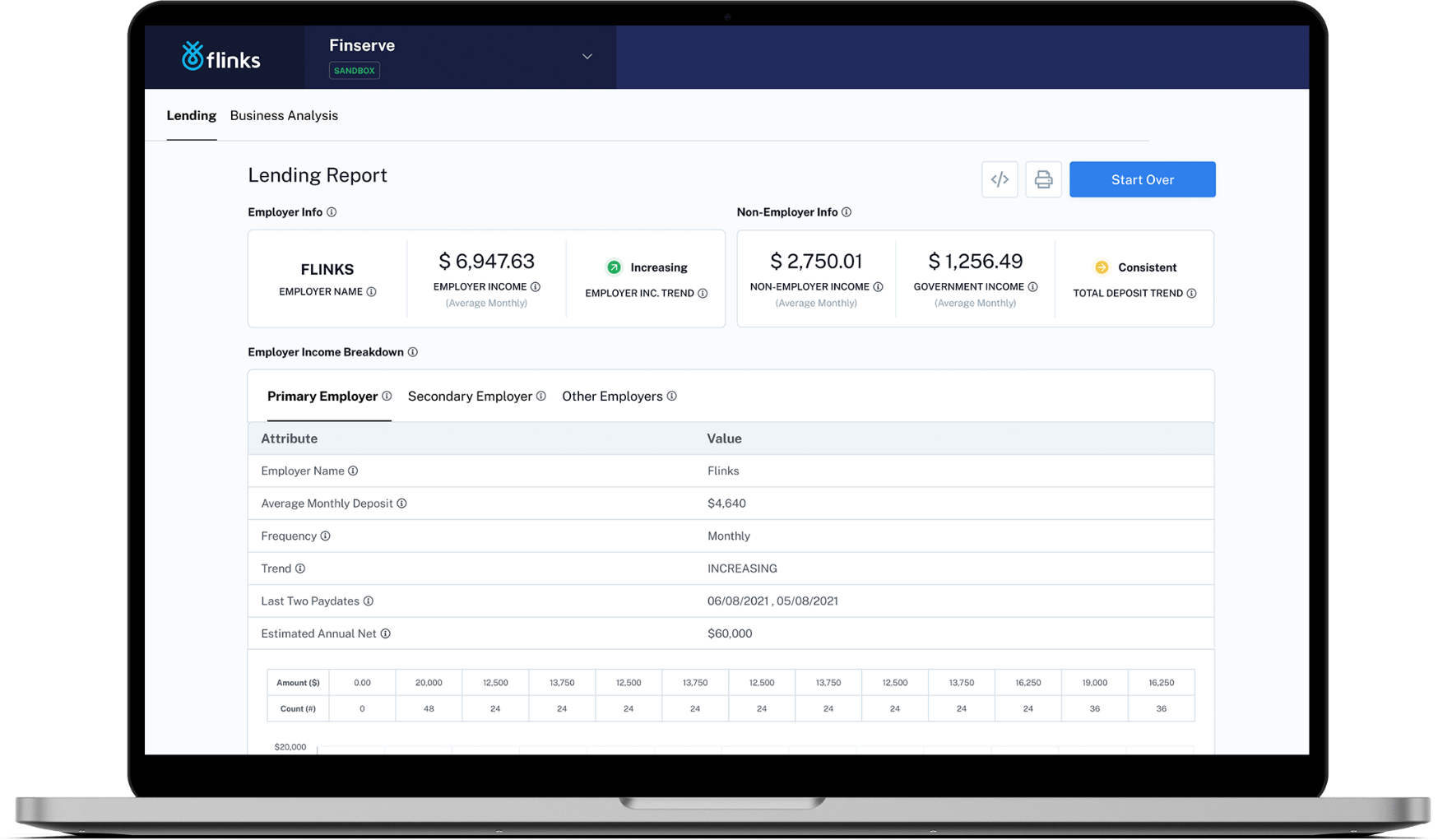

Flinks Client Dashboard

Out-of-the-box lending reports that visualize borrowers’ banking data insights and automate your underwriting processes. No code or development work needed.

Solutions for:

Consumer Lending

Commercial Lending

Mortgage Financing

Auto Financing

Fintech Lending

Interested in learning more?

Contact our sales team today and find out how to put Flinks to work for you.

What our customers say about us

Don’t take our word for it. Our customers love us, and here’s what they say on G2.